Type

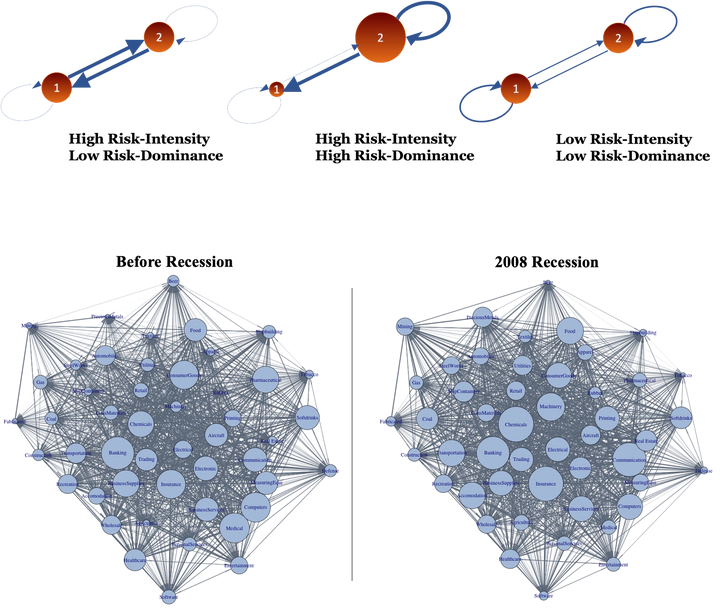

Firms are interconnected through a complex trade network. Specifically, firms purchase various inputs from other firms to produce their unique goods, which, in turn, serve as inputs for their customers. This supplier-customer chain enables idiosyncratic risk to spill over from one firm to another. In this paper, I investigate the dynamics of idiosyncratic risk spillovers. By conceptualizing firms as nodes and idiosyncratic volatility spillover as directed linkages, this paper examines the network implications of risk transmission for aggregate volatility and asset prices.