I am an Assistant Professor of Finance at the Shanghai Advanced Institute of Finance (SAIF), Shanghai Jiao Tong University.

I work on macro-finance and asset pricing. My research focuses on understanding the economic and asset-pricing implications of production networks, particularly in the presence of idiosyncratic risk spillovers and the formation of persistent aggregate risk.

Education

Ph.D. in Finance, 2020 - 2025

University of Illinois at Urbana-Champaign

MS in Applied Mathematics, 2019 - 2020

University of Chicago

BS in Mathematics, 2015 - 2019

University of Chinese Academy of Sciences

Exchange Program, 2018

Carnegie Mellon University

Interests

- Macro Finance

- Asset Pricing

- Idiosyncratic/Aggregate Volatility

- Network

Job Market Paper

I adopt a network perspective to provide a microfoundation for aggregate volatility risk. Theoretically, I develop a dynamic multi-sector model and show that inter-sectoral idiosyncratic volatility spillovers, arising from a persistent and asymmetric production network, generate both the origins and variations in aggregate volatility. These spillovers affect asset prices through the volatility-risk channel and, when investors prefer early resolution of uncertainty, through the cash-flow news channel as well. Empirically, I construct two theory-motivated network factors that capture the dynamics of idiosyncratic volatility spillovers and show that they significantly predict future aggregate volatility and are priced as volatility risk factors.

Online Appendix

Working Papers

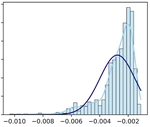

(with Tim Johnson)

This paper examines the microfoundation of macroeconomic tail risk, defined as the frequency of extremely negative GDP downturns relative to what is predicted by a normal distribution. We demonstrate that firm-level productivity shocks, even when normally distributed, can be amplified into large macroeconomic tail events through a dynamic production-based input-output network, challenging the traditional view that only sufficiently large firm-level shocks impact the aggregate market. The evolving network structure, driven by technological shocks, hinders risk diversification across firms, delays the mean reversion of aggregate volatility, and causes volatility to cluster from local to global scales over time. In bad times, when idiosyncratic risks are high and firms treat all inputs as complementary, these risk spillovers can accumulate, resulting in severe GDP downturns.

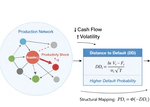

(with Jonathan Brogaard)

We develop a structural model of credit counterparty risk in which contagion arises from an inter-firm production network. We then propose a parsimonious empirical approach that directly incorporates network topology to predict credit spreads. We find that incorporating network edge features induces an average credit-spread change of approximately 21.8% and yields an incremental R2 of 0.56 in explaining credit spreads. Our results show that network-based counterparty risk is strongly priced and plays a first-order role in shaping credit spreads, particularly during periods when production networks experience severe disruption, reorganization, or rewiring. Network effects are especially important for firms operating in industries that occupy intermediate positions within supply chains, rely heavily on distribution and logistics, and face low substitutability of inputs.

Contact

- chenchen@saif.sjtu.edu.cn

- (+1) 773-219-4229

- 211 West Huaihai Road, Shanghai, 200030